Limit For 403b Contributions 2025 Over 55 - Limit For 403b Contributions 2025 Over 55. The maximum 403 (b) contribution for 2025 is $23,000. Employees age 50 or older may contribute up to an. 401k And 403b Contribution Limits 2025 Cristy Melicent, On your end, you can defer up to $23,000 from your salary to your 403 (b) in 2025.

Limit For 403b Contributions 2025 Over 55. The maximum 403 (b) contribution for 2025 is $23,000. Employees age 50 or older may contribute up to an.

403b Max Contribution 2025 Over 50 Elsy Karlene, For 2025, the limit on annual additions has increased from $66,000 to $69,000.

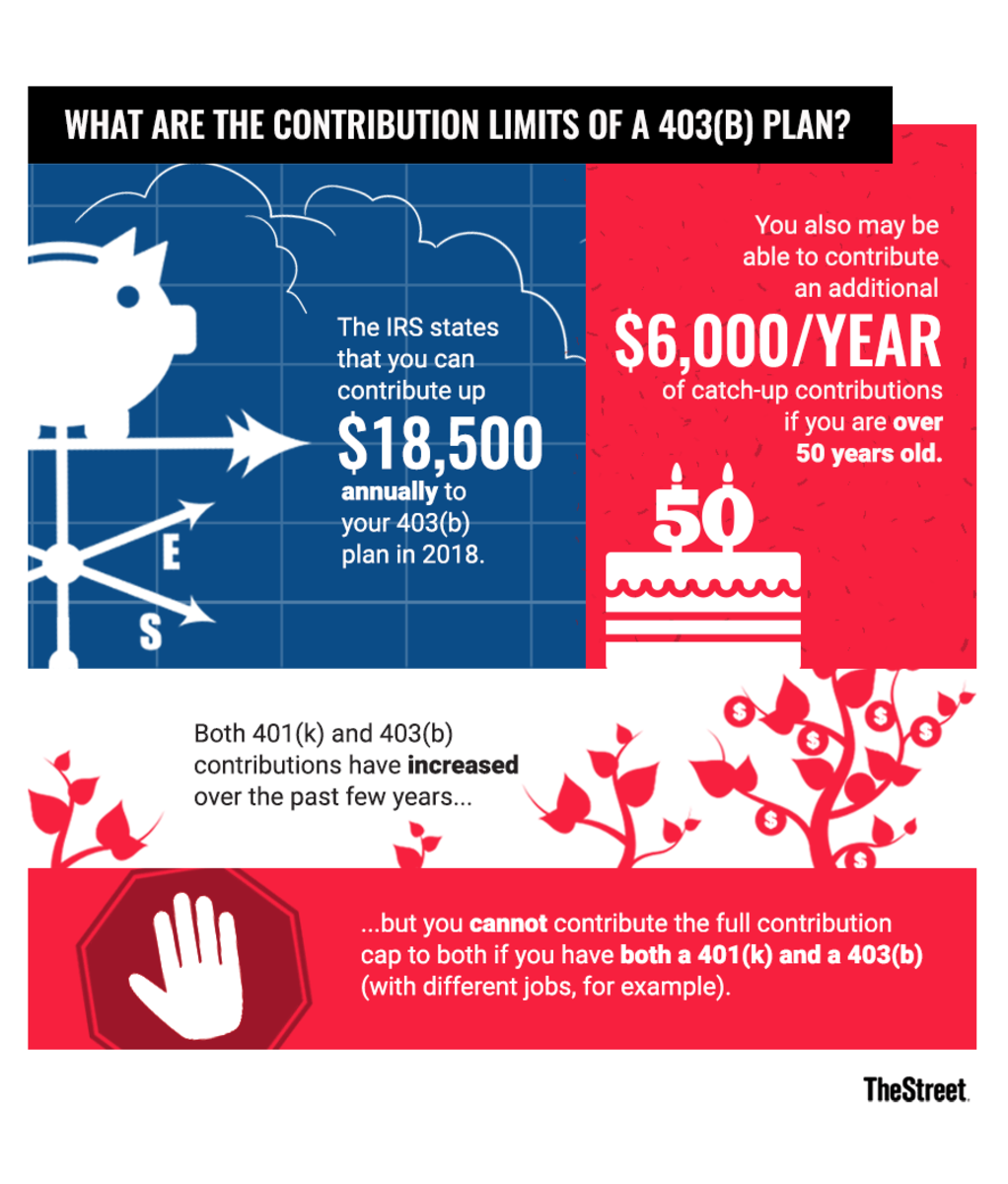

If you are under age 50, the annual contribution limit is $23,000. If you exceed this contribution limit, the irs will tax your funds twice.

2025 Max 403b Contribution Limits Over 50 Daffie Jerrine, The 401k/403b/457/tsp contribution limit is $23,000 in 2025.

403b Limit For 2025 Nicol Anabelle, For 2025, the combined employee and employer contribution limit for a 403 (b) plan is $69,0000, an increase of $3,000 from 2023.

403b And 457 Contribution Limits 2025 Moina Terrijo, However, some workers are eligible to contribute to both a 401 (k) and a 403.

Hsa Contribution Limits 2025 Over 50 Amity Beverie, The irs elective contribution limit to a 403 (b) for 2025 starts at $23000.

Maximum 403b Roth Contribution 2025 Elke Sabina, In 2025, the contribution limit for a 403 (b) is $23,000, which is the same as a 401 (k) for this year.

Annual 403b Contribution Limits 2025 Marji Shannah, For distributions made after december.

2025 Irs 403b Contribution Limits Catlee Alvinia, 403 (b) contribution limits are $22,500 in 2023, and $23,000 in 2025.